XINSURANCE

3 Reasons to Buy Taxi Insurance Online

If you haven’t already, it may be time for you to jump on the rideshare app bandwagon. Companies such as Uber and Lyft are making it easier than ever for car owners to earn some extra money. However, for all of the benefits that come with this job opportunity, it can all turn around in an instant, especially if you did not buy taxi insurance.

No driver, whether for taxi drivers or a rideshare app, should pick up a client or hit the road before purchasing a good taxi insurance plan. It can serve as a safety net in the event of an accident or mishap while driving. It is necessary for drivers or shareholders to feel safe from potential liability they may face when behind the wheel. A good plan can be easier to find than you might think, especially when you consider all of the available online options.

There are a number of benefits that can only happen when you decide to buy taxi insurance online.

Streamlined Process & Better Customer Experience

Professional drivers can ill afford to be unavailable for pick-ups for extended periods of time. This makes it very difficult to go to multiple locations to search for the best policies. Time is money, and only through the online web can you ensure that you will be able to find what you need in the fastest way possible.

Access to Customer Reviews

Honestly, what would we do without customer reviews? They are the first resource we turn to when we need to learn more about an unfamiliar company, providing us with a genuine, first-hand experience to learn from. It is a wonderful thing to have access to so many reviews that allow us to gain inside knowledge of how a company really treats its clients.

We owe all of this to the Internet for turning shopping into such an easy process. With just a few clicks of your mouse, you can find and compare the best taxi cab insurance plans available. You can eliminate the stress of wondering where the best coverage plan is by finding it online, instantly.

Easily Compare Plans & Find the Best One

Arguably, the best thing about shopping for taxi insurance online is being able to compare so many plans at the same time.

When you conduct your search online at your convenience, you can learn about a company’s plan while comparing it with a competitor.

When looking for the best plan, you want to make sure you are getting the proper coverage that is worth the investment. Companies like XINSURANCE offer plans that are fully customizable, ensuring that you only have to pay for the exact kind of coverage you want. We also offer customers the chance to take advantage of our “all-in-one.”

Visit XINSURANCE.com to learn more about our unique and customer-friendly coverage plans, and see just how easy it can be to buy taxi insurance online.

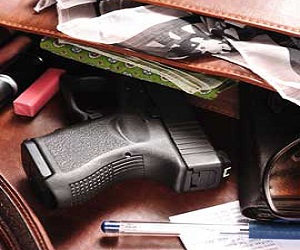

Firearm Liability Insurance: The Best Protection You Can Have

While your firearm may be able to protect you and your family from harm’s way, what is there to protect you and your gun? If you do not have a firearm liability insurance plan to turn to when things don't go as expected, then you are not as secure as you might think.

Gun ownership is perhaps the most controversial subject in the United States. Everyone feels very strongly about one side of the issue or the other, whether in favor of gun ownership rights or against. Regardless of the emotions around this issue, there are still plenty of reasons why a person could and should own a firearm for protective purposes.

For one thing, a gun is typically the preferred tool for hunting. It is in our DNA to want to hunt, after all, and the act of hunting has grown to become a meaningful experience with family members. The most common reason to own a gun is for keeping yourself and your loved ones safe. Sometimes there are incidents that require having a firearm to prevent things from getting worse.

In the right hands, a gun can be a useful tool for hunting and safety. A smart gun owner knows to keep their firearm of choice somewhere secure and only uses it when absolutely necessary. But in the wrong hands, a gun can be used to cause serious harm to others. It can be difficult to find good insurance for a firearm because of the line between it being a useful tool and a dangerous weapon. Even the most responsible gun owner can face serious consequences in the event their firearm has to be used or their gun is stolen. In these events or others like them, the person who owns the gun can run into legal issues with serious financial penalties. In times like these, having great firearm liability insurance coverage can make all the difference in the world.

Notice how that last sentence says “great” instead of “good”? That is because settling for anything but a great plan would be doing a disservice to yourself. You have to be certain that the coverage you are paying for will actually protect you in the event of firearm liability, an accidental discharge, or any other potential risk that your gun could cause. Check out the plans at XINSURANCE.

A firearms liability insurance plan from XINSURANCE will provide you with some peace of mind thanks to the customizable coverage plans that they offer. With this, you can be sure you are only paying for the type of coverage that you want. They also provide an all-in-one approach that can help customers relax and know that all services are under one roof.

Go to XINSURANCE.com to customize a plan that is best for you and provides you with the freedom you need to be the best gun owner you can be.

Concealed Carry Insurance: A Must-Have for Responsible Firearm Owners

If you consider yourself to be a responsible firearm owner and do not want your choice in personal protection to come back to bite you, then it is imperative that you have a reliable concealed carry insurance policy by your side.

Firearm ownership is arguably the most controversial subject matter in the United States today. While some people consider them to be a major liability and accident waiting to happen, others view them as a constitutional right and necessary for effective defense in the face of very serious threats. The point of this article is not to argue for or against one side, but to help those who own firearms of their own. If you do consider firearms to be a necessity for your protection, then you need to understand the importance of safe ownership and setting a good example for other like-minded owners. When it comes to playing the part of a responsible firearms owner, concealed carry insurance is not only just a good idea, it can be the difference between losing or keeping your protection.

For all the good that a firearm can provide to a person, it still carries a number of unforeseen injuries and accidents. It is just the nature of gun ownership; while you might never want to pull it out and use it, the fact of the matter is, there could be a time when you have no choice but to use it to protect yourself or others. In times such as this, having just a concealed carry permit might not be enough. You will still be responsible for answering exactly why you needed to use your gun, and can still run the risk of having it taken away and potentially losing your right to own any future firearms.

Did you know that were your gun to be stolen from you and used for criminal purposes, you could still be held responsible? Not many gun owners are aware of this fact until it is too late and they have found themselves in hot water. While there are so many risks and concerns that can come from gun ownership, there are a number of options that responsible owners can take to protect their firearms and themselves from legal backlash. This is where insurance for concealed carry comes into play.

Concealed carry insurance is designed to protect you and your assets from potential risk. However, many policies offered by insurance companies are too generic and filled with gaps in the coverage that might not provide the kind of protection that you need. The plans offered by XINSURANCE are specifically designed to fill in gaps that are not covered by other insurance providers.

Best of all, plans from XINSURANCE are completely customizable so that you can ensure you are only paying for the types of coverage that you want and nothing more. Visit XINSURANCE.com to find out more about their great policies and how you can benefit from their unique all-in-one approach to coverage.

Dangerous Dog Insurance Is A Canine's Best Friend

While your family dog may be your best friend, he can be seen as an accident waiting to happen by others. Even a playful nip or run around the yard can cause damage to a person or their property, leaving you liable. This is why it is an essential duty of any good dog owner to have a reliable dangerous dog insurance policy in place to protect them and their family.

Do you know what is the leading cause of homeowner’s insurance claims? It is damage that is caused by dogs. Despite this fact, most insurance companies fail to offer the kind of coverage dog owners actually need. Not only do they offer limited dog bite insurance, but they put strict limits on the kinds of dog breeds they are willing to cover. This is just from the companies that even offer animal coverage in the first place.

If you have a four-legged friend that can tend to be a little too affectionate or a neighborhood with a gripe against your pet, then you might know just how critical it is to have a safety net such as dangerous dog insurance in place. The same is also true for owners of dogs that have been unfairly labeled as the “bully breeds” by others. In some states, owners of dogs such as these or ones with a bite history are required to carry proper animal liability coverage. With so many requirements for dog owners and so few insurance providers that you can depend on, it is a blessing that XINSURANCE is to pick up the slack.

XINSURANCE makes it their job to fill in the gaps left by other insurance providers, which is why they offer the perfect dangerous dog insurance plan for any pet owner. They provide protection for any dog breed, including the dangerous breeds, service dogs, guard dogs, therapy dogs and more. Most importantly, it provides coverage to the two areas dog owners need most: bodily injury and property damage to third parties. They are the insurance partner you can turn to for protection in the event of a mishap or accident caused by your dog.

What really sets apart XINSURANCE and their animal liability coverage is their unique all-in-one approach to providing the coverage people want most. They offer customizable plans that ensure you are only paying for the things you feel are worth the cost. Think of them as the best friend to man’s best friend, a partner that wants to see your favorite pet as happy and safe as can be.

If you are ready to give your family the right coverage that it needs, then head over to XINSURANCE.com as quickly as you can.

3 Crucial Reasons to Buy Bus Insurance

Are you debating whether or not to buy bus insurance for your drivers and bus company?

Providing a safety net for you and the people working for you is imperative for ensuring that everyone can work to their fullest ability without constantly looking over their shoulders. While most insurance carriers may offer generic plans that will provide surface-level protections, it is unlikely these types of plans will be there to keep you secure when you really need it most.

Let us have a look at a few of the reasons why a great insurance policy for bus companies is so important and where you can find policies that are a cut above the rest.

1. Safety

While this may seem obvious, it certainly bears repeating. There are few things more important to bus drivers than the safety of their passengers, other drivers, and themselves. Even the most careful drivers can still get into an accident, and they could find themselves and their employers in hot water regardless if they were at fault or not. With the right insurance plan in place, everyone from the newest driver to the CEO of the whole company can rest a little easier knowing that they have a reliable safety net in place were the worst to happen. Having such a safety net can protect more than just money, and can provide many benefits.

2. Reduce Stress

Even with the growing popularity of ridesharing apps, buses are still used by many people as a primary source of transportation. A lot of people under one roof like that can get a little stressful, especially for the person at the front who is responsible for the safety of everyone aboard. Too much stress can lead to a higher chance of an accident or other workplace mishap occurring and your company losing a lot of money from an ensuing lawsuit. Drivers that are aware of a good insurance policy in place can breathe a little easier and focus on getting everyone where they need to be promptly and safely.

3. Quality Coverage

This might not be available with some insurance companies, but it is for people who buy bus insurance through XINSURANCE. This top-of-the-line insurance partner is willing to offer their unique, all-in-one approach to any company in need, regardless of past claims history, insurance history, accidents, or safety scores. When others turn your request away, XINSURANCE is there to extend an open and helpful hand. Their plans are customized to provide the exact coverage you want and will extend as far as you want them to.

Go visit their website at XINSURANCE.com to learn more about what it means to have an all-in-one approach to insurance coverage by your side. Work with any of their expert underwriters to build the perfect plan for your company and employees so that you can feel safe and secure knowing that you and your bus are covered.

3 Reasons Why You'll Be Grateful You Got Therapy Dog Liability Insurance

As the number of dog bites and dog attacks goes up around the world, it is important to ask yourself if your current therapy dog liability insurance plan is enough for you.

If you do not have a proper therapy dog liability insurance plan in place, then you are doing you and your furry friend a disservice. There are several benefits to having coverage for your therapy dog in the rare chance that it ever hurts another person or causes damage to a person's property. Let us explore a few of the reasons people with this liability protection are so grateful for their investment.

1. Sense of Security

With the right insurance plan in place, your therapy dog has its own safety net built-in in the event of a mishap or accident. Not only that, but it can also provide the protection your finances need in the case of a lawsuit or litigation. So while your beloved therapy dog works to make other lives better, you can feel good knowing you have done the same for him.

2. More than Just Volunteer

While most therapy dog organizations typically provide their own insurance policies, they only cover volunteer therapy and cannot be trusted for anything further. Were you to use your therapy dog for commercial use or even try to start your own therapy dog organization, then you would need additional coverage that is your responsibility to find. Fortunately, XINSURANCE has customizable plans that can easily meet the needs of anyone looking to use their therapy dog for more than just volunteer therapy work. The plans are customizable so you can be sure to get the exact kind of coverage that you want and need.

3. Reduces Stress

Let’s face it: for all of the great work that your therapy dog does for you, it cannot eliminate all of your stress and worries on its own. It helps when you take the initiative to drive away some of those worries on your own, which is exactly what therapy dog liability insurance can help do. Having the proper policy in place will take one more big thing off of your mind and allow you to start living a more relaxed life. Having great coverage like the one offered at XINSURANCE will take a big weight off of your shoulders and provide some much-needed peace of mind.

Visit XINSURANCE.com today to find out how you can get the right customizable coverage for you and your needs. Discover the benefits of trying their unique, all-in-one approach to providing great coverage.

Snow Removal or Snow Plow Insurance: The Perfect Way to Let Stress Melt Away

Those who work in snow or ice removal play an incredibly important role in keeping everyone safe during the harshest parts of winter. If you work in this in-demand and important field, then it is essential that you find insurance partners that truly value what you do and work to keep you safe by offering Snow Removal or Snow Plow Insurance.

For most parts of the United States, winter is an equal balance of beauty and burden. While many of us dream of seeing a white Christmas, snow can quickly turn into a major inconvenience once the New Year starts. Then there is the ice – the bane of most drivers’ existences.

The combination of snow and ice is a terrible combination for drivers, which is why the number of accidents on the roads drastically increases during the winter season. That number would be a lot higher if it were not for the efforts of the men and women hired to remove most of the snow and ice from our roads.

In fact, the demand for snow removal businesses and snow plowing services has greatly increased due to the higher than average annual snowfall totals and high-accumulation snow events, according to an industry market research report done by IBIS World. This demand is not expected to die down anytime soon and may actually increase as time goes on.

Considering how important these services are to the vast majority of us, it’s a no-brainer for insurance carriers to do their part in keeping snowplow operators safe while on the job by offering Snow Removal or Snow Plow Insurance. For anyone who makes their living by clearing out snow; a lack of proper insurance coverage may make businesses hesitant to hire you because they will be on the hook for any negligence or harm caused by you while on the job. With their livelihood on the line, no snowplow operator can afford to be without some form of liability coverage for their business.

Bad weather conditions, poor visibility of your surroundings, and a lack of awareness for pedestrians or other motorists are just a few of the potential problems that can lead to snowplow accidents and serious financial losses without an effective insurance plan in place. Even problems that are caused entirely by faulty equipment can be blamed squarely on the operators. For many operators, one claim of negligence can ruin their whole business, which means one less professional out there to make our roads safer.

XINSURANCE is here to make sure snowplow operators have an insurance plan in place for Snow Removal or Snow Plow Insurance. Their innovative all-in-one approach lets operators breathe a sigh of relief knowing that they are covered in the event of property damage, bodily harm, or other issues that may arise. Their unique approach allows their customers to get customizable coverage with limits up to $10 million with excess limits available.

If you are without Snow Removal or Snow Plow Insurance to protect your snow plow business and plow equipment, then go to XINSURANCE.com to learn more about what they can do to help. Get a free quote in no time at all or speak to any of their well-trained staff to find the best plan for your business.

Need a Hassle-Free Contractor Liability Insurance Quote? Try XINSURANCE

As your own boss, you know that time is one of your most important resources. That is why you should not waste any more time than necessary to get a Contractor Liability Insurance Quote that is also free.

Being a self-employed contractor can be at times a bit of a double-edged sword. On one hand, it is very freeing to know that you get to call the shots and do not have to answer to anyone. Whether you are an experienced contractor who has built a strong reputation or a beginner with an entrepreneurial spirit that is looking to break into the field, you understand how great it feels to set your own schedule and wages. It is such a great feeling, in fact, that, according to NPR, the Labor Department states that 1 in 10 United States workers classifies themselves as independent contractors. That comes out to over 10 million workers who share the same drive and passion as you.

However, being an independent contractor is not without its risks and headaches. For starters, you are responsible for hunting down potential job opportunities and building relationships with prospective clients to keep the work coming in. Without this, you could soon find yourself without enough work to pay the bills. Client non-payment is an issue that has plagued many independent workers. Insurance is another issue that freelancers and independent contractors must deal with because companies do not cover independent contractors. Perhaps the biggest issue that many independent contractors have to deal with is protecting them and their business in the event of a lawsuit.

Lawsuits against independent contractors are quickly becoming more and more common in this country. It is no surprise, given how good lawyers have gotten at sniffing out potential insurance policy exclusions. While the general liability insurance policy that most independent contractors have covers them for some things, there are enough exclusions for legal experts to find and exploit, especially when it involves any frivolous claims. While these claims may have little or no merit, they can still cost you considerable time and money to fight, two things you might not have enough of to sacrifice in order to clear your name. The objective of being self-employed is to make as much money as possible without having to spend money on unnecessary things.

Since most companies are not held vicariously liable for the actions of contractors, they cannot be counted on to have your back during these trying times. Neither can most insurance companies since some can lack the necessary policies that independent contractors like you badly need. Fortunately, XINSURANCE makes it easier than ever to find the perfect plan for you and your personal business. They offer independent contractors like you the opportunity to get a Contractor Liability Insurance Quote quick and easy on their website at XINSURANCE.com.

What makes XINSURANCE so attractive to self-employed workers is the customizable coverage they offer. This makes sure that you can get the precise protection you want and need. They also provide an all-in-one approach that you will not find anywhere else. This approach allows you to get broader coverage with limits up to $10 million or more in certain cases. Best of all, XINSURANCE cares about your success and well-being and will be there for you when you need it.

Go to XINSURANCE.com to get a Contractor Liability Insurance Quote for free and get back to work with the protection you deserve.

The Importance of Having Foster Care Liability Insurance

Being a foster parent is a very rewarding role that more people should take on, but without a solid Foster Care Liability Insurance coverage plan in place, you could be taking on more than just another child. Fortunately, there are options out there that are in your family’s best interest to seriously consider.

There are not many things more admirable than fostering a child. Being able to take in a young soul full of potential, sometimes saving them from bad situations, and giving them a chance at having a real family is one of the noblest things we as humans can do for each other. Whether bringing them into a group home or a new family, providing foster care can be a major responsibility that, if you are not careful, can lead to more headaches than you anticipated. With more than 400,000 children living in foster care, there is a fairly decent chance that problems can arise that can put you and your family in a tough position. According to some studies, 80% of all child maltreatment allegations are found to be false, but will still cause damages to your finances and personal life that can be very hard to come back from.

There is the possibility of property damages caused by a new foster child, allegations of abuse or mistreatment, and the possibility of a lawsuit from the child’s biological parents. All of these occurrences can, in turn, lead to hefty legal fees, defense costs, and award judgments that can put a real strain on your bank account. Worst of all, you could potentially lose the chance to foster other children in need moving forward. These kids need a good home and having Foster Care Liability Insurance can go a long way toward keeping your family and home safe in the event that the worst were to happen.

Much like the young ones who turn to you for protection and guidance, it is important for you to know who you can trust in these serious situations. Foster Care Liability Insurance is not easily found or offered by many major insurance companies, but XINSURANCE has made a living off of filling in the cracks found with their competitors. XINSURANCE is well known for offering unique, customizable insurance plans that you will not easily find anywhere else, including great plans for foster families. Their Foster Parent Protection Plan acts as a safety net that will provide for your legal defense against criminal allegations or civil litigations. This is all thanks to their famous all-in-one approach to providing insurance that has made them so famous and helped set them apart from the pack.

If you are ready to go back to fully enjoying the blessings that come from being a good foster parent, then head over to XINSURANCE.com to learn more about what they can do for you. Do not let fear keep you from being a positive role model in someone’s life, instead move forward with confidence and the peace of mind of knowing that you have a great protection plan in place. While on their website, be sure to get a free quote and learn more about what other interesting coverage plans you can get for you and your family.

Stop Searching for a Commercial Truck Insurance Quote

If you are feeling exhausted by your seemingly endless search for a Commercial Truck Insurance quote, then you will be happy to know that it is not all doom and gloom for you and your commercial trucking business.

Getting a Commercial Truck Insurance quote from a reputable insurance partner has never been more difficult than it is today. The chances of finding any kind of quote or coverage are slim to none, let alone a customizable one that will easily meet your specific needs. Most insurance companies are abandoning the commercial auto market left and right these days and could even cancel you for growing too fast. Many of today’s truckers rely heavily on GPS to know where they are going and when they should arrive at their final destination. Most drivers use the navigation systems on their phones, and truck drivers on phones are 23 times more likely than other drivers to be involved in an auto accident, according to a study done by the Virginia Tech Transportation Institute.

According to the Federal Motor Carrier Safety Administration, nearly 12% of all fatal accidents on U.S. roadways involve at least one large truck. This makes many insurers wary of providing coverage to commercial trucking companies, even if your company is not part of the problem. It is obviously unsafe to have your drivers and vehicles on the road without some sort of protection in the event of an accident, so what are you to do? Call XINSURANCE, that’s what.

For close to 30 years, XINSURANCE has been a close ally of the commercial trucking industry, specializing in providing the kind of insurance coverage you and your company need. More importantly, they offer customized insurance plans for new operations and can even help if your claim history is not good or if you have failed a few safety inspections. All it will take is a simple review of your operations and experience level to create the perfect policy your company has always dreamed of but perhaps never thought could be possible. They are the ideal partner for any kind of commercial trucking business, whether it is long-haul, short-haul, auto haulers, logging operations or anything in between.

What you will find with XINSURANCE that you won’t find anywhere else is a unique all-in-one approach to customizable coverage. This will allow your company to get broader coverage and up to $20 million limits with higher limits available through reinsurance partners. This is an innovative solution to truck liability insurance protection that can provide commercial truckers the peace of mind they deserve while out on the open road. It will ensure that you get good protection for commercial auto liability, physical damage coverage, and any other kind of coverage you may need.

If you want a Commercial Truck Insurance quote or want to learn more about the exciting offers that are waiting for you, then head on over to XINSURANCE.com. You can fill out a short form and they will get back to you in no time. You can also call (877) 585-2853 to speak with any of the experts in their underwriting department.

Security Guard Insurance: A Must-Have for Security Professionals

Even the brave men and women who work in the security industry need protection of their own. That is why Security Guard Insurance is there for those who need it, even though not every insurance agency makes the effort to provide it.

There are many different careers within the security services industry from bodyguards to bouncers. Armed security guards, in particular, take on a great deal of risk while on duty. They take on job assignments that may require them to risk their health and well-being for not as much pay as one might expect and very little in terms of protection in the event something were to happen to them or they are accused of excessive force or other behavior that can get them named in a liability lawsuit. Security workers at restaurants, bars, and clubs are constantly getting sued for just trying to do their jobs. With so much risk involved in these types of careers, it is unfair how few insurers are willing to offer them any kind of protection or coverage, not unlike how they are willing to cover doctors from malpractice.

Security professionals are more often than not the first line of defense for protecting many of the world’s most important leaders or assets. They are the keepers of the peace who take on the burden of keeping others safe with little fanfare or adoration to show for it. Even worse, many of them are left without little to any form of protection in the event of a lawsuit. Despite the great sacrifices armed and unarmed security professionals make every day on the job, there just does not seem to be enough safety nets in place for them. Even the security guard companies that employ these individuals are often left in the dust and lack any kind of Security Guard Insurance to protect them or their employees.

While many of the nationally-recognized insurance companies continue to drag their feet when it comes to offering Security Guard Insurance, XINSURANCE makes it a point to offer this kind of protection with customizable coverage. Their business model is to provide the kind of unique coverage that other, bigger named companies are unwilling to offer, and it has allowed them to offer coverage to those who might think they have been forgotten or left behind. They fully understand and appreciate the daily risks involved in this line of work and act as their own kind of security service to those who are willing to do the same for others.

If you work in the security guard industry or run your own security company, then you should head over to XINSURANCE.com to learn more about their unique approach to insurance coverage that will help minimize some of the risk you take on, while making sure to fully maximize the peace of mind you or your employees more than deserve. You can get a quote in no time at all on their website, or contact any of their well-trained underwriters to learn more.

On Your Mark, Get Set, DON’T Go Without Track Day Insurance

For race car drivers, there is no place on Earth they would rather be than the track. From the smell of burning rubber to the sounds of cheering fans, there is nothing they love more than putting the pedal to the metal and their driving skills to the test. While testing the limitations of your car is what racing is all about, smart drivers know that the only thing they need more than speed is Track Day Insurance.

The life of a racecar driver can be thrilling, but it can also be incredibly dangerous. There are many forms of racing – drag racing, autocross, karting, etc. – and each comes with their own set of risks that can vary in severity from a scratch to serious bodily harm. What is even more likely to be damaged on race day, however, is the vehicle. Of course, it is obvious which of the two we would all rather have take the damage. The high likelihood of racers hurting other drivers on the track makes it difficult to find auto insurance carriers that will cover them. In fact, 99% of all auto insurers exclude driving on a track, according to XINSURANCE.com. This means the vast majority of racers are out on the track risking harm without any kind of protection from liability or physical damage.

If you consider yourself a lover of all things fast and furious and care about the well-being of yourself, your car, and other drivers, then it is important to choose an insurance provider that will provide Track Day Insurance. Having this type of insurance will help you feel safer on race day knowing that someone besides your pit crew has your back. Aside from your helmet or the special equipment in your vehicle, there are not many other forms of protection that a racer needs more than a type of insurance made specifically for them.

Finding a quality insurance partner that provides Track Day Insurance at a fair price can often be as easy as finding a needle in a haystack. Most carriers are hesitant to insure people who partake in such a dangerous activity – no matter how much they may love what they are doing. The only way to feel truly protected when you are out on the racetrack is to find an insurance company that understands and respects your favorite pastime. That is what draws many racers and thrill-seekers to XINSURANCE, a company that has a wide variety of unique insurance policy solutions. Their track day policy will ensure that you are covered while on the track, and they also cover drivers for personal liability in the event of a lawsuit.

Go to XINSURANCE.com right now to learn more about their insurance policies for drivers and anything else you have that could require good coverage in case the worst were to happen. It will only take you five to ten minutes to get a quote from one of their many well-trained underwriters, and they will work with you to find a solution that can make everyone happy.

When Life Gets Ruff, There’s Dangerous Dog Insurance

A dog is man’s best friend, and yours is likely no exception. They are the perfect partner for playing, walking, or cuddling with after a long day. However, for those moments when our canine companions get a little unfriendly, it helps to have a Dangerous Dog Insurance policy in place.

According to the Centers for Disease Control and Prevention, there are roughly 4.5 million people who are bitten by dogs every year, 885,000 of which end up requiring medical attention. Worst of all, the two most likely victims of dog bites are children and the elderly, the two most fragile age groups in our society. The average payout for a dog bite claim was $37,051 in 2017, according to a report from the Claims Journal. The number of attacks and payouts has increased every year, making it increasingly more difficult for dog owners like you to find an insurance partner without severely limited dog bite coverage.

As a caring dog owner, it might be hard to see your furry friend as a potential liability risk. Despite all of the hard work you put into training them and making them a loving animal, all it takes is one incident of playful nipping or damaging a neighbor’s property to cost you a lot in insurance payouts. Even if your dog is as sweet as can be, they are unfortunately grouped in with other dangerous dog breeds, some of which are restricted from coverage by most major insurance agencies.

You might not know this, but dog-related damages are actually the #1 cause of homeowner’s insurance claims. This makes it all the more frustrating that it can be so difficult to find an animal insurance policy that fully protects you and your pet from liability claims and leaves you wide open for costly and time-consuming legal issues. Thankfully, for the dog owner who wants an insurance partner who loves their pet almost as much as they do, there is XINSURANCE, a leading provider of unique insurance solutions many people do not realize are available to them, such as Dangerous Dog Insurance.

XINSURANCE makes it a point to provide you and your dog with the kind of protection you both deserve. Not only does their policy cover bodily injuries and 3rd party property damage, but it also provides coverage for any kind of dog breed, or specially-trained ones such as service dogs, guard dogs, or therapy dogs. While their coverage does not extend to injuries to the insured or their families, it will make sure you are fully protected from any lawsuits or liability claims from outside parties who do not see your lovable pet as a part of the family.

Visit XINSURANCE.com to learn more about their Dangerous Dog Insurance and the benefits it will bring to you and your family, especially the four-legged member. You can get a quote in no time on their website, or call (877) 585-2853 to speak to any of their well-trained insurance experts.

3 Reasons to Have Insurance for Auto Repair Shops

For some odd reason, there is a growing number of shop owners who don’t think Insurance for Auto Repair Shops is worth their investment. If you happen to be one of these shop owners or work for someone who thinks like this, there are a number of reasons why this is a bad idea. Let’s take a look at three of the biggest reasons why your shop needs insurance.

1. It Acts as a Safety Net in Case of Accidents

The auto repair industry can, at times, be incredibly stressful – there are short deadlines to meet and a lot of work that needs to be done on very expensive vehicles. You and your employees are constantly around dangerous tools, chemicals, and equipment, oftentimes relying on them to get the job done effectively. One slight mishap can lead to serious damage to any of your expensive tools or, worse, to a customer’s beloved car. Having a good insurance plan in place will let you breathe a little easier knowing you have some form of protection from liability in place when you need it. XINSURANCE offers Insurance for Auto Repair Shops, and with their customized all-in-one approach, you can feel safe knowing you and your business are covered.

2. It Provides Protection to the Little Guys

Did you know that 75% of all aftermarket auto repairs are performed by small, independently-owned auto repair shops? The automotive aftermarket industry is currently booming. It is expected to reach over $722 billion by next year, according to a study from V12 Data. All of these profits could make it a prime target for sue-happy individuals who are unhappy with your work, and smaller shops lack the firepower that the bigger ones have for protection. This makes getting Insurance for Auto Repair Shops all the more important. Having an insurance partner that will provide you with the protection your shop needs is one of the most important things you can have.

3. It is More Affordable Than You Might Think

Do you know what happens when people assume things? They miss out on great benefits for their businesses. Some insurance providers will not only offer you a great price on a plan, but they will also offer a great price on a plan that can be easily customized to fit your shop’s specific needs. Take XINSURANCE, for example, an insurance partner that specializes in offering unique coverage plans that many other agencies won’t go near including customizable Insurance for Auto Repair Shops. Their unique approach offers your shop a chance at broader coverage and higher limits you won’t find with every agency.

If you are ready to find a comprehensive insurance plan that is perfect for your auto repair shop, then head over to XINSURANCE.com to get a fast and easy quote. If you prefer speaking with someone directly, their skilled underwriters can also be reached at (877) 585-2853.

Keep the Fun Going and Your Business Safe with Boat Rental Insurance

Spending time out on the water is becoming an increasingly popular way to relax or put our problems on hold for a moment. For people who choose to enjoy their free time out on a lake or the ocean, a boat can help maximize the good times. Anyone in the business of renting boats, jet skis, or kayaks should understand the importance of Boat Rental Insurance and how to find the right one to keep your business safe from whatever might happen.

There are a lot of fun activities that can be had on the water, especially when you have a boat. From racing through the waters in a speed boat to spending some much needed time sunbathing and relaxing on a yacht, boats are an incredibly popular way to make the most of your time on the water. That is why owning and operating a boat rental business can be such a lucrative venture and a chance for people to share their love of boating with others. However, there are certainly a lot of accidents and liabilities that can happen out on the water. In 2017 alone, there were over 4,200 boating accidents and roughly $46 million of property damage because of these accidents. One mishap out on the water can doom your business unless you have the right Boat Rental Insurance plan to protect you in case of the worst.

Not everyone who rents a boat is a world-class captain fit for the open water. Some people are unprepared for navigating through rocky water, handling unruly waves, or dealing with unexpected bad weather. Others are just plain reckless out there. Whatever the case may be, it is the boat renter who is responsible for handling any damages accrued or claims made. Unless they have Boat Rental Insurance in place, they run the risk of taking serious financial losses. It also takes the right insurance provider to have your back and provide you with the best plan possible for you and your business.

Many insurance carriers seem to have your back, but will only offer you a basic coverage plan that does not protect you from all the liabilities that are out there. That is why many people are turning to XINSURANCE and their unique all-in-one coverage approach to protecting their businesses. By choosing to go with the all-in-one approach, business owners can have broader coverage, up to $10 million limits with higher limits available through reinsurance partners, a partnership approach, and direct access to underwriting, risk management, and claims management. Not only do they offer higher limits, but they also provide users with specialty liability insurance coverage that can cover more of the risks that life and the water can throw at boat renters.

Visit XINSURANCE.com to find out how their all-in-one approach to coverage will keep you and your property safe from any accidents, even if you have been denied or canceled coverage. Get a quote on their website and find the customized coverage that is perfect for you and your needs.

Sources:

U.S. Coast Guard Boating Safety Division

Independent Contractor Insurance Made Just for You

At XINSURANCE, we believe that no one should have a fear of being under-covered. That is why we offer customized liability insurance policies, including Independent Contractor Insurance, that cover additional areas applicable to you that most traditional insurance companies do not cover. Most offer appropriate coverage for homeowners, business owners, and employers. However, in today’s society, there are hundreds of areas of exposure that can lead to a lawsuit. At XINSURANCE, we do our best to fill the gaps that traditional insurance companies do not. As a self-employed independent contractor, it’s important that you take serious legal precautions to ensure that you are appropriately protected if you should ever find yourself in a difficult legal situation such as a lawsuit. Our Independent Contractor Insurance provides you with quality coverage that will protect you in case any legal problems should arise. Continue reading to learn about our Independent Contractor Insurance, how requesting a quote works, and what we do to provide you with the best insurance fit.

Independent Contractor Insurance

Over 10 million workers in the United States classify as independent contractors. Many independent contractors today are protecting themselves with general liability insurance. However, some of these general liability insurance policies do not completely protect you as an independent contractor. That is why we offer Independent Contractor Insurance costs with a premium coverage that is specific to you and your line of work.

How Does It Work?

Thanks to our underwriting team, that has over 30 years of experience, you have the ability to get customized limits, coverage, deductibles, and premiums that are appropriate for you, your line of work, and your hobbies. Getting a quote for our Independent Contractor Insurance is simple; just fill out the contact form available on our website with your information and we’ll be in touch with you as soon as possible to get the process started.

You can also browse through the product lines available on our website to find the perfect insurance coverage for you. If you’re unsure of which product line is right for you or if you don’t see a policy right for you listed on our page, we can work with you personally to create a special customized coverage plan that will meet your specific, unique needs.

Who Can Purchase XINSURANCE?

If you’ve struggled with denied, non-renewed, or canceled coverage in the past, don’t worry. At XINSURANCE, we’ve worked with individuals and businesses that have been struggling to get traditional carriers to insure them, and we’re always available to assist you with whatever needs or concerns you might have regarding additional coverage.

Other Product Lines

Our other insurance product lines include animal liability, commercial liability, medical professional, entertainer liability and many more. We’re always striving to provide our customers with the high quality, personalized coverage they deserve. Our product lines are always expanding depending on what specialty coverage is needed among our customers.

If you have any questions about our product lines or would like to work with us to create a customized line that is completely personalized for you, you can contact us via phone, email, fax, or visit us online at XINSURANCE.com. Contact us today at 877-585-2853 for additional information about Independent Contractor Insurance costs and anything else or feel free to email us your request and information to info@xinsurance.com. Minimize your exposure and maximize your peace of mind with XINSURANCE.